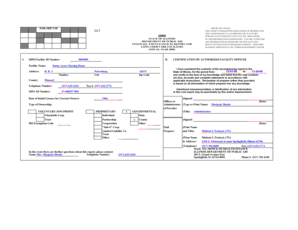

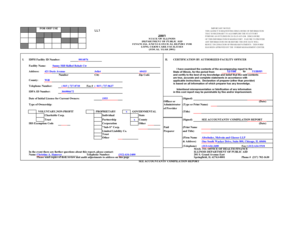

TCF Bank Direct Deposit Form free printable template

Show details

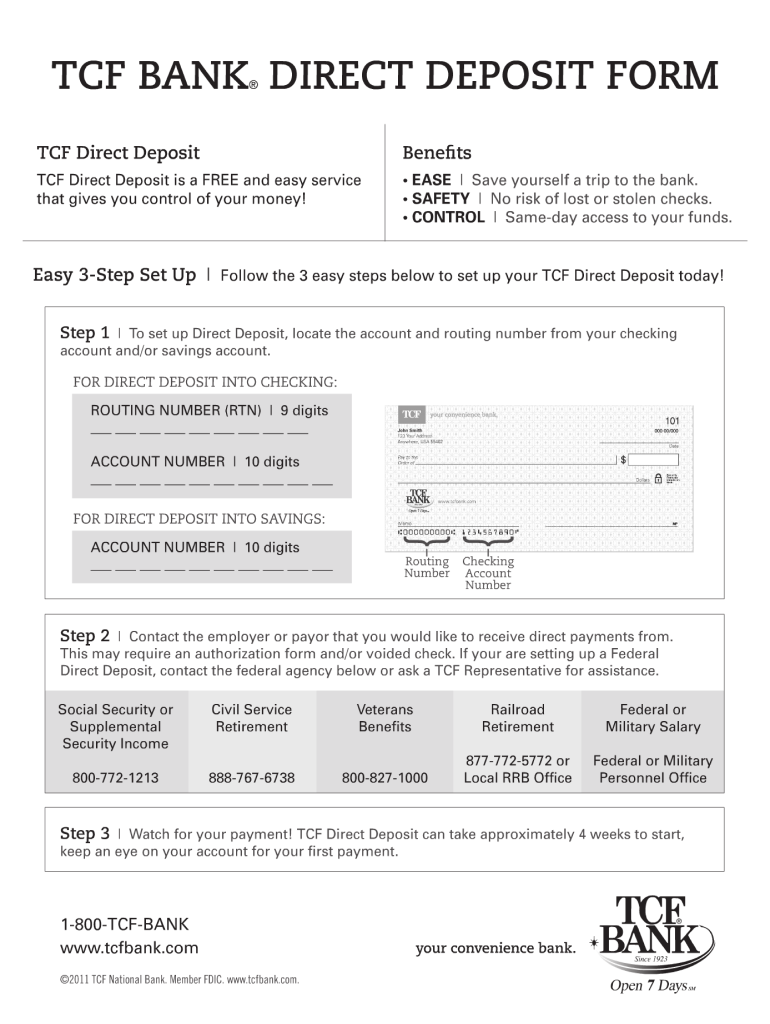

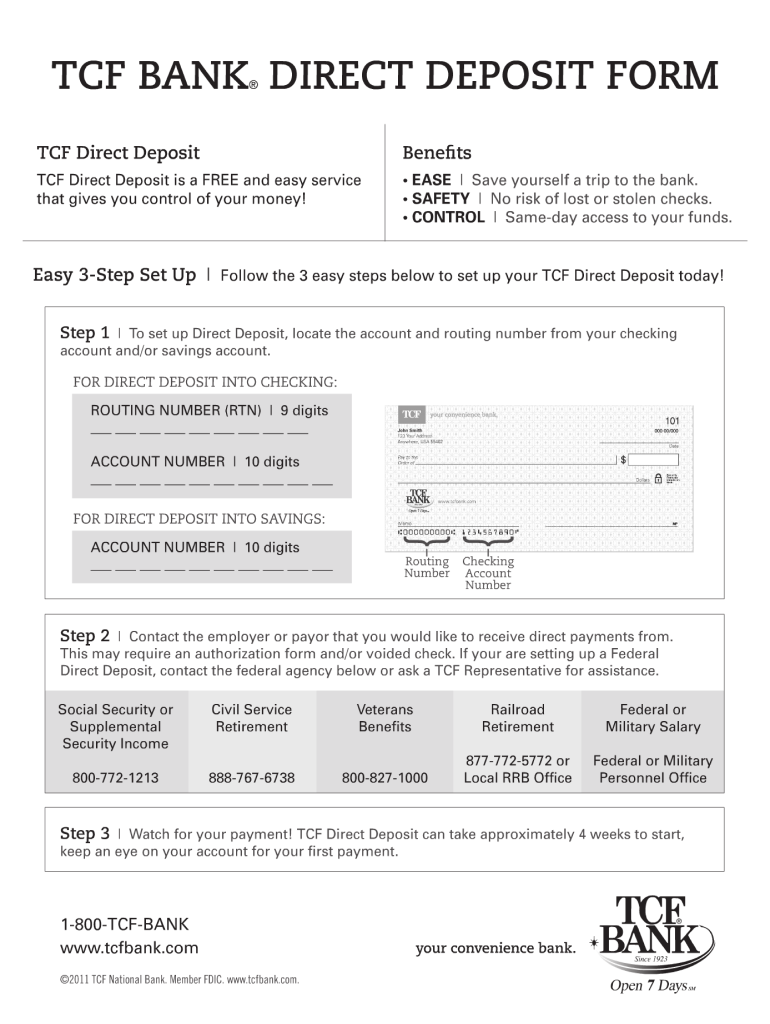

TCF Bank Direct Deposit Form TCF Direct Deposit TCF Direct Deposit is a FREE and easy service that gives you control of your money! Benefits EASE Save yourself a trip to the bank. SAFETY No risk of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tcf form

Edit your ncsecu direct deposit form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your routing number tcf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tcf bank api online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit when must you sign a deposit slip a you must always sign a deposit slip b you only need to sign a deposit slip when receiving cash c you only need to sign a deposit slip when using an atm rather than depositing at the bank d you never need to sig form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

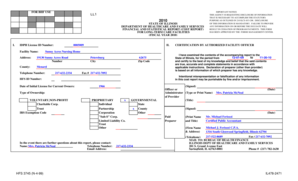

How to fill out td bank checking deposit slip form

How to fill out TCF Bank Direct Deposit Form

01

Obtain the TCF Bank Direct Deposit Form from your employer or TCF Bank website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide your bank account number where the deposits will be made.

04

Select the type of account (checking or savings).

05

Include TCF Bank's routing number, which can be found online or on your checks.

06

Review all information for accuracy.

07

Sign and date the form.

08

Submit the completed form to your employer or the designated department at your organization.

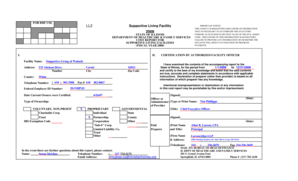

Who needs TCF Bank Direct Deposit Form?

01

Employees who want to receive their salary or wages directly into their bank account.

02

Individuals who want to automate their payments, such as government benefits or pensions.

03

People who prefer the convenience and security of direct deposits rather than paper checks.

Fill

ncsecu direct deposit form

: Try Risk Free

People Also Ask about tcf document

What are 3 ways to make a deposit?

Fortunately, there are several options available, whether you're looking to deposit the funds electronically or in person at a bank branch. Deposit cash at the bank. Make an electronic transfer. Make a wire transfer. Write a check. Use a cashier's check. Use a money order. 7 best ways to send money.

How do you fill out a deposit slip for deposit only?

0:01 1:54 How to Fill Out a Deposit Slip - Carousel Checks - YouTube YouTube Start of suggested clip End of suggested clip The first line says cash. This spot is for any cash you're depositing count the cash you'reMoreThe first line says cash. This spot is for any cash you're depositing count the cash you're depositing. And write the amount where it is listed cash.

What are two ways you can deposit money?

If you need to deposit cash into your bank account, you have several options, including your local bank branch or an ATM that accepts deposits. While it isn't possible to make deposits directly to most online banks, there are often workarounds, like using a money order or an in-network ATM.

Can I print my own bank deposit slips?

Unlike printing a check, you don't need special paper to print deposit slips. You also don't need a special printer and can use any printer to print deposit slips.

Can I create my own direct deposit form?

Most banks offer a link on their website that says “Set up Direct Deposit” where you are able to create a customized direct deposit form. By clicking on the pre-filled form, you will add the needed information electronically and save it to start the deposit process.

How do I write a direct deposit letter?

To whom it may concern: I am writing to request direct deposit of my paycheck into my account at Commerce Bank. Enclosed is a completed Direct Deposit Authorization form, which includes the required bank account information as well as my contact information. A voided check is also enclosed.

How do I fill out a direct deposit slip?

How To Fill Out a Deposit Slip Provide Personal Information. Fill in Additional Details. List the Cash Amount of Your Deposit. List Checks Individually. Add Up the Deposits for a Subtotal. Enter the Amount of Cash You'd Like To Withdraw. Calculate the Total Deposit. Sign the Deposit Slip.

How do I fill out a bank deposit form?

Follow these steps to fill out a bank deposit slip. Make sure you provide your name as it appears on your account. Include the account number. If you are requesting cash back, you may be required to sign the deposit slip in the appropriate space. Fill in how much cash you're depositing, if any.

Do you have to fill out a slip to deposit a check?

Some banks will let you make a deposit without a deposit slip if you give the money to a teller who will use a keypad or ask you to swipe your debit card. You can skip filling out a deposit slip if you are making a mobile deposit. Simply download the app and take a photo of the check.

Do you have to fill out a deposit slip at the bank?

You are typically only required to sign a deposit slip if you want to get cash back from the deposit. If you are depositing money through an ATM, no deposit slip is required, so you do not have to sign anything.

How do I write a direct deposit authorization form?

I hereby authorize {Enter Company Name} to directly deposit my pay in the bank account(s) listed below in the percentages specified. (If two accounts are designated, deposits are to be made in whole percentages of pay to total 100%.)

What are examples of deposits?

A deposit is a sum of money kept in a bank account. The two types of deposits are demand deposits and time deposits. Demand deposit accounts include checking accounts, savings accounts and money market accounts. Time deposit accounts include certificate of deposit (CD) accounts and individual retirement accounts.

Do banks require a deposit slip?

Deposit slips are becoming a thing of the past as banks have begun removing deposit slips from their branches in favor of new technology. Most banks do not require deposit slips for ATM deposits since the computer can read the check or count the cash and electronically credit the account associated with the ATM card.

What are the 3 types of deposits?

Types of Deposits Savings Bank Account. Current Deposit Account. Fixed Deposit Account. Recurring Deposit Account.

Are deposit slips free?

If you want to make a deposit at your bank, you need to fill out and submit a bank deposit slip template. You can get these slips for free from your bank.

How do I write a direct deposit form?

What to Include on Your Direct Deposit Authorization Form Company Information. Employee Information. Bank Account Information. “I hereby authorize…” Statement. Employee Signature and Date. Space for Attached Physical Check (Optional) Find a Direct Deposit Provider. Setup and Implementation.

How do I make a bank deposit slip?

How To Fill Out a Deposit Slip Provide Personal Information. Fill in Additional Details. List the Cash Amount of Your Deposit. List Checks Individually. Add Up the Deposits for a Subtotal. Enter the Amount of Cash You'd Like To Withdraw. Calculate the Total Deposit. Sign the Deposit Slip.

What are the main types of deposits?

There are two main types of deposits: demand and time. Demand deposit: A demand deposit is a conventional bank and savings account. Time deposits: Time deposits are those with a fixed time and usually pay a fixed interest rate, like a certificate of deposit (CD).

What information do you need to write in a deposit form?

A deposit slip contains the date, the name of the depositor, the depositor's account number, and the amounts being deposited as well as break down of whether the deposit is comprised of checks, cash, or if the depositor wants a specific amount of cash back from a check deposit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tcf order checks directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your TCF Bank Direct Deposit Form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send TCF Bank Direct Deposit Form to be eSigned by others?

TCF Bank Direct Deposit Form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out the TCF Bank Direct Deposit Form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign TCF Bank Direct Deposit Form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is TCF Bank Direct Deposit Form?

The TCF Bank Direct Deposit Form is a document used by customers to authorize their employer or other sources of income to deposit funds directly into their TCF Bank account.

Who is required to file TCF Bank Direct Deposit Form?

Individuals who wish to receive their salary, pension, or any other payments directly into their TCF Bank account are required to file the TCF Bank Direct Deposit Form.

How to fill out TCF Bank Direct Deposit Form?

To fill out the TCF Bank Direct Deposit Form, you need to provide information such as your name, address, account number, routing number, and the type of account (checking or savings) you are using for the direct deposit.

What is the purpose of TCF Bank Direct Deposit Form?

The purpose of the TCF Bank Direct Deposit Form is to facilitate the electronic transfer of funds directly into a customer's bank account, ensuring timely and secure payment without the need for physical checks.

What information must be reported on TCF Bank Direct Deposit Form?

The information that must be reported on the TCF Bank Direct Deposit Form includes your full name, address, TCF Bank account number, bank routing number, and the type of account for the deposit.

Fill out your TCF Bank Direct Deposit Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TCF Bank Direct Deposit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.