Get the free direct deposit settings form

Get, Create, Make and Sign

Editing direct deposit settings online

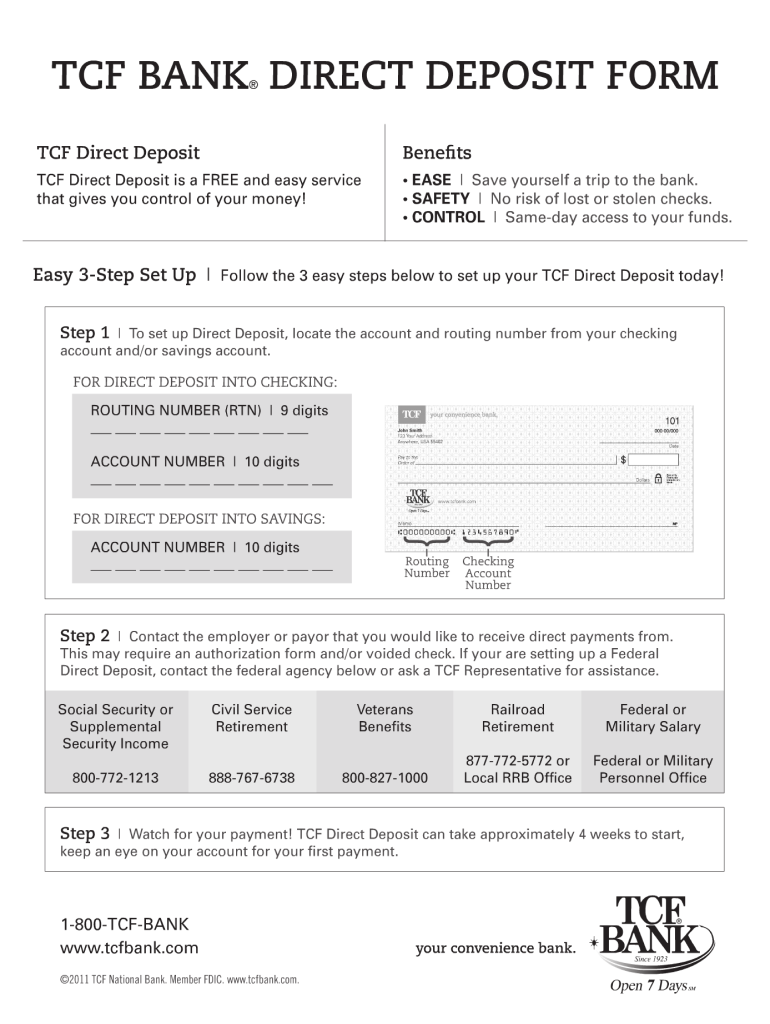

How to fill out direct deposit settings form

How to fill out how to bank deposit:

Who needs how to bank deposit?

Video instructions and help with filling out and completing direct deposit settings

Instructions and Help about tcf bank deposit online form

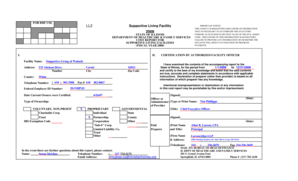

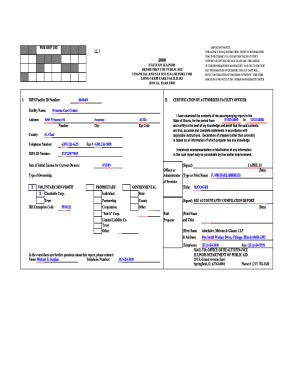

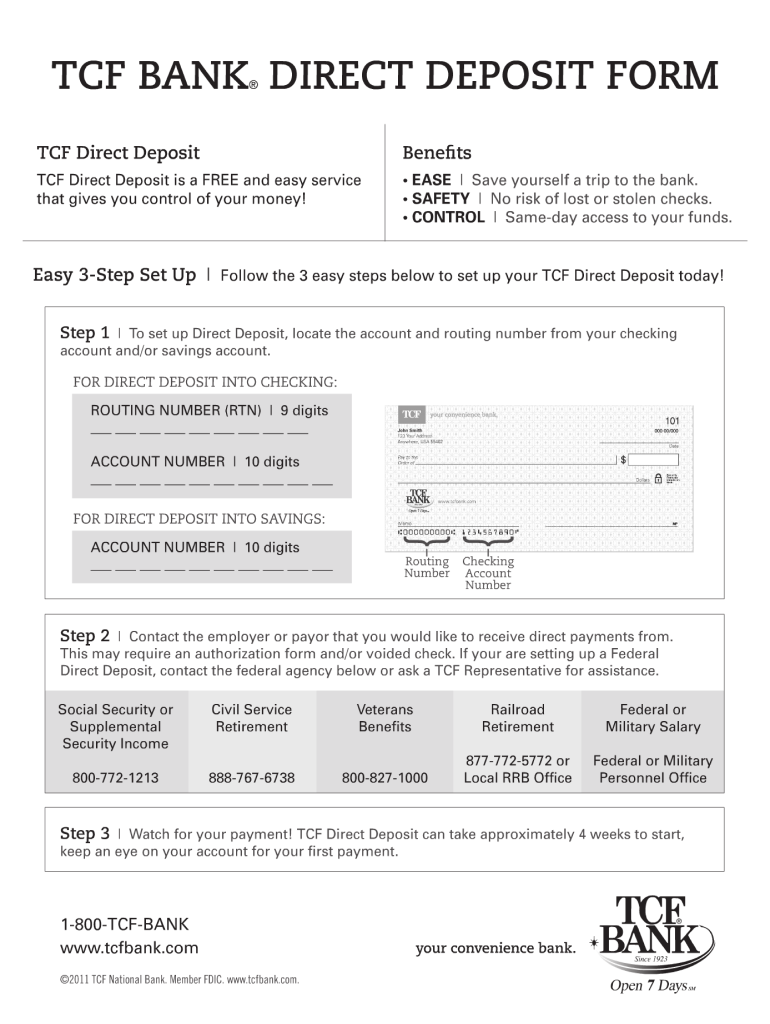

Today we're going to learn how to fill out the paychecks direct deposit form the first thing you're going to do and this would be for a new employee or an employee who wants to make a change in the way their paycheck is currently being deposited so at the very top you're going your first middle initial or name and your last name right below it, you're going to enter the last four digits of your social security number next you're going to move to the box where it says bank account number, and you're going to enter your account number you select the type of account you have whether it's a checking or savings account in this case we're going to say it's a checking account, and then you're going to enter the bank name next you're going to move over to the direct deposit type, and you're going to decide whether you want your remainder of net pay you want one that you want 50 percent of your net pay or a specific dollar amount put into that account, and I'm going to say we want our whole remainder of net pay put in there if you had a second account you would do the same thing right below here you would enter the bank account number the type of account where there's checking or savings the bank account name again and the way you want your pay so if the first one you wanted you could select you want a 50% to go to Gold finger bank and the other 50% going to this bank next you're going to move down on the form, and you're going to attach one of the following you have to have an avoided check with the name imprinted, and it cannot be a starter check a deposit slip, and it's going to have the herbage a CTR tee which appears before the routing number or a bank letter that's signed by your local bank representative, and we're going to include avoided bank Chuck lastly you're going to move down on the forum and the worker are going to sign their name right here and date the form and if the for is the account that you're using if gold finger Bank was James Bond's wife and not his you would have her sign here if she was the account holder, and he is not and that is basically all you have to do lastly you're going to return the form to the HR coordinator, and she will send it or he to paychecks and that is how your paycheck will be deposited

Fill tcf deposit : Try Risk Free

People Also Ask about direct deposit settings

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your direct deposit settings form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.